Small Business Health Insurance Guide to EpiPen Costs

How Much Will an EpiPen Cost on Your Insurance Plan?

Knowing how much your prescription drugs cost is a key factor for many people in selecting a health insurance plan. For many people, an EpiPen is a critical prescription purchase for themselves or their children, but it can be very confusing to find clear cost information.

SimplyInsured went through thousands of small business insurance plans to help you identify the cost of EpiPens under each plan, and help you select the best health insurance plan for covering an EpiPen. (Looking for specific coverage & rate information? See every carrier & plan online at SimplyInsured.)

Factors Determining Your Cost of EpiPen

Part of the reason why figuring out how much an EpiPen will cost are the multiple factors that go into insurance coverage for EpiPen. Your final cost will come down to the following factors:

- Whether the insurance carrier includes the EpiPen as part of their prescription coverage

- What tier of prescription is the EpiPen classified as, such as preferred or non-preferred brand prescription

- Whether the insurance plan has a separate prescription drug deductible

- What the copay is under the specific insurance plan

That’s a lot of things to keep track of! Luckily, we’ve done the work for you and put together a guide to EpiPen coverage and costs for every California insurance carrier and plan.

The Best Plans in California

Which Insurance Carrier Should I Select?

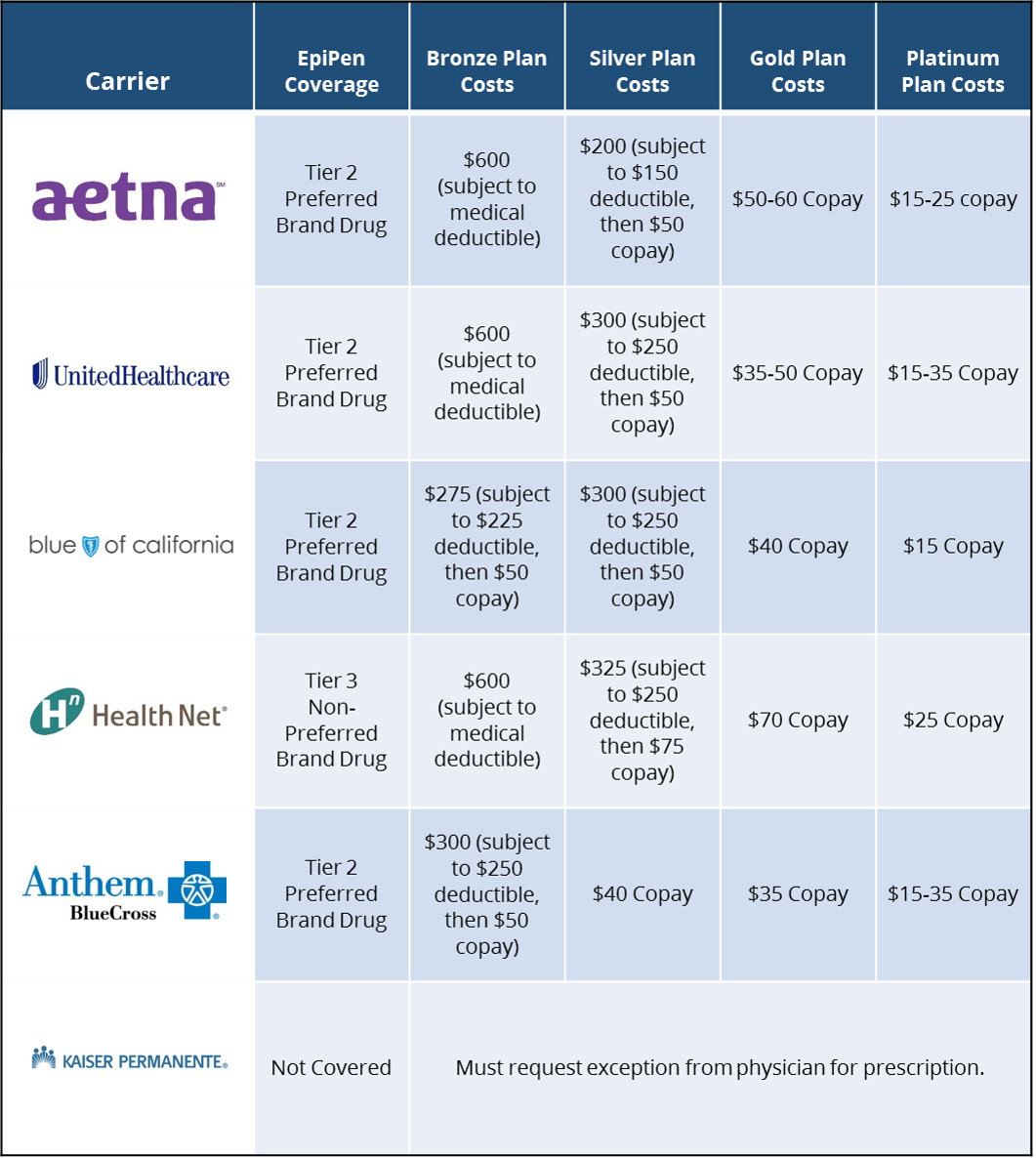

Only four insurance carriers in California treat EpiPen as a preferred brand name prescription: Aetna, United Healthcare, Blue Shield, and Anthem Blue Cross. Coverage for the EpiPen under these carriers will be the most favorable, with lower copays and more available coverage.

HealthNet covers the EpiPen, but as a non-preferred brand drug and requires a higher copay. Kaiser does not include the EpiPen by default and requires separate authorization for access.

Which Plan Should I Select?

In California, there are 3 types of plans that are the best option for EpiPen coverage, given the out of pocket cost to purchase an EpiPen pack and the premium cost of the plan.

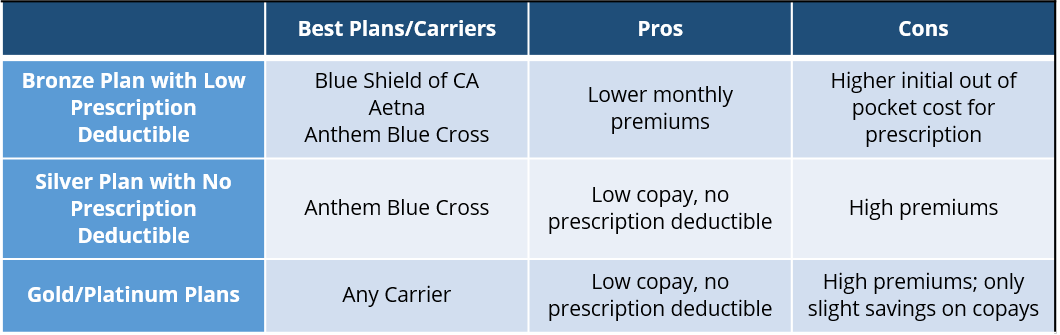

1. Bronze Plans with Lower Separate Precription Deductible

Blue Shield of California, Aetna, and Anthem Blue Cross offer lower premium cost bronze plans that have $225-250 prescription drug deductibles. That means for the 1st EpiPen purchase, you’ll pay the $225-250 deductible plus a $50 copay, with a total out of pocket expense of $275-300 for a 2-pack.

2. Silver Plans with No Prescription Deductible

Many silver plans have started requiring a separate prescription deductible to be met before cover brand prescriptions at a low cost copay, making these plans less attractive than similar bronze plans. The exception is Anthem Blue Cross still offers a silver plan with no prescription deductible, and you’ll immediately pay only the $40 copay for each EpiPen pack.

3. Gold & Platinum Cadillac Plans

Across all carriers, plans in the gold and platinum tier cover EpiPens at a lower copay and without requiring a prescription deductible to be met. However, the plans tend to be much more expensive and only offer slightly lower copays compared to silver tier plans.

EpiPen Coverage Summary by Insurance Carrier