Individual vs Small Business Health Insurance Guide: San Jose Edition

What’s the Better Value in San Jose – Individual or Small Business Health Insurance?

We get asked that question a lot from small business owners on whether it is better to get coverage under their business or from the individual health insurance exchanges.

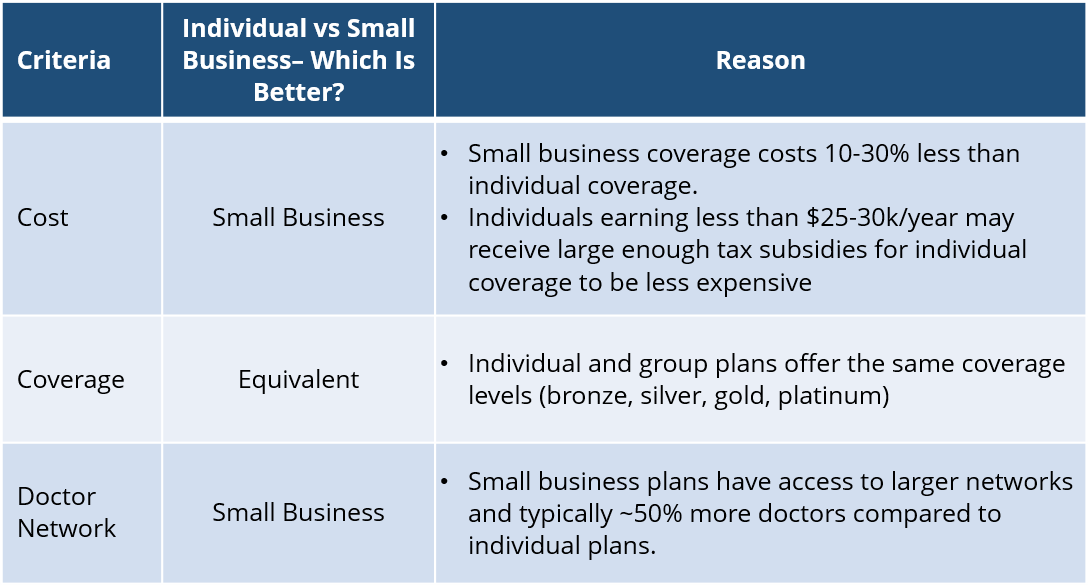

To find whether individual or small business health insurance is better, we looked at differences in the cost, coverage, and network to find the best value.

Individual vs Small Business Health Insurance – Which is Less Expensive?

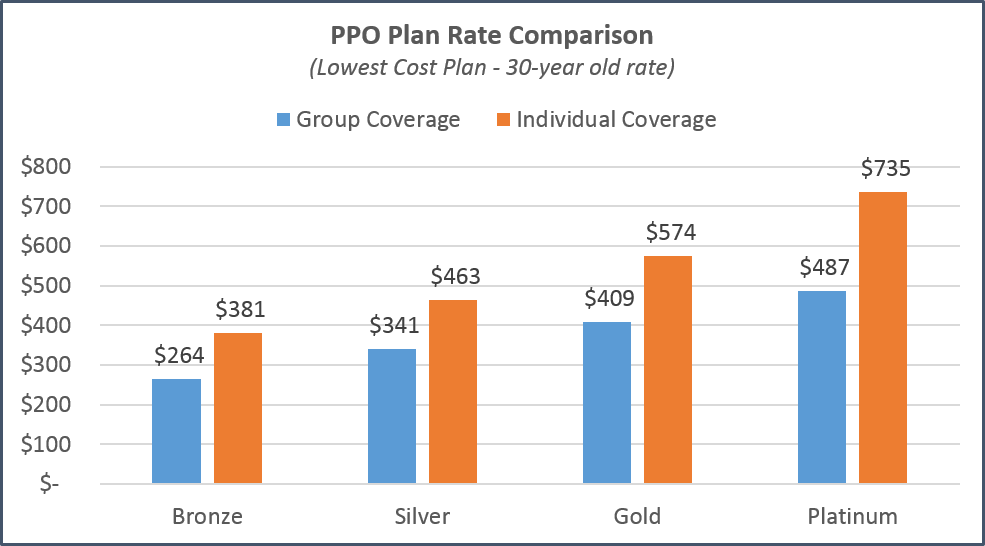

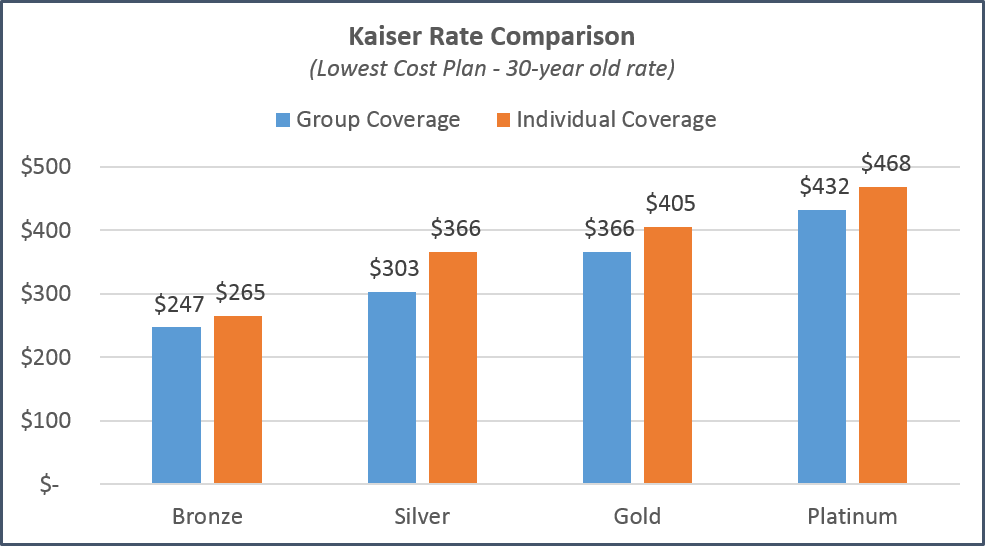

In San Jose, small business premiums are 10-30% less expensive than individual premiums:

- PPO plans are on average 30% less expensive for small businesses than individuals for similar tiers of coverage

- Kaiser plans are on average 10% less expensive for small business than individuals for the same type of coverage

For more information about small business and individual insurance plans, you can find specific coverage & rate information at the links below:

- Small Business Plans: See every carrier & plan online at SimplyInsured.com.

- Individual Plan: See individual plans and subsidies on Covered California.

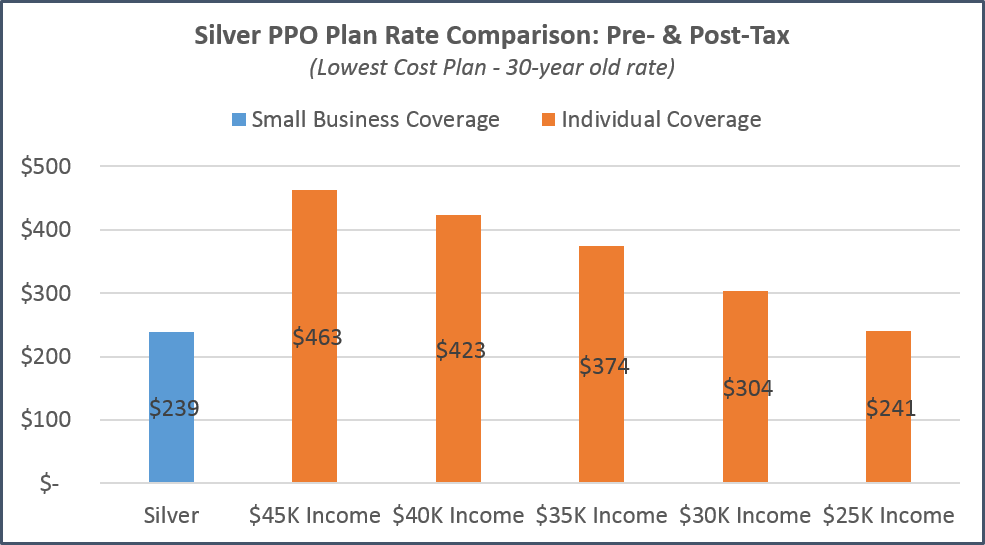

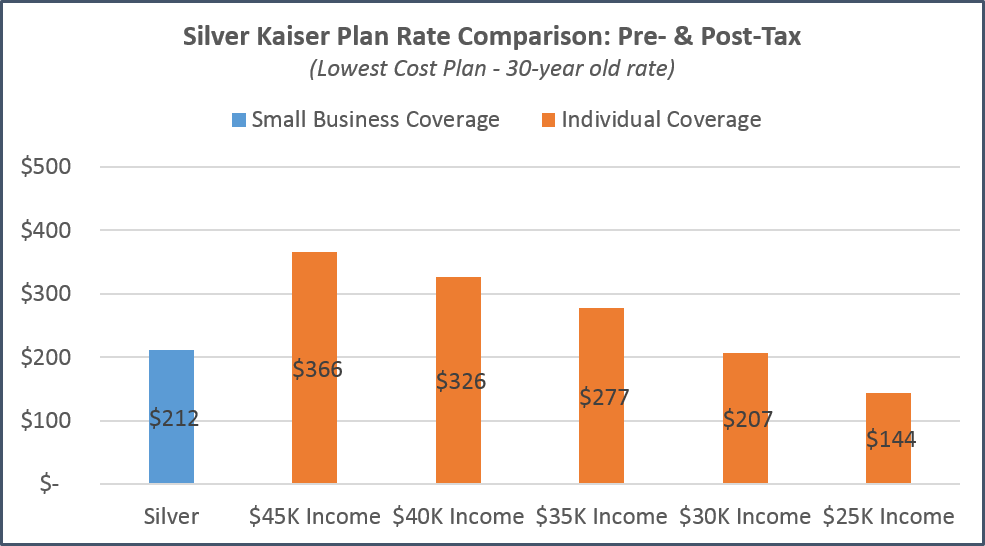

Costs after Taxes and Subsidies

The second factor to examine is whether the after-tax cost of small business coverage and is lower than cost of individual plans with tax subsidies:

- Small business plans are tax deductible, which reduces the cost of coverage by the business tax rate (typically 25-35%)

- Individual plans receive a subsidy to individuals with incomes below $44,000/year. The lower the income, the larger the subsidy amount.

In order for the post-subsidy cost of an individual plan to be less than small businesss coverage, your annual income would need to be below $25K-30K/year.

Individual vs Small Business Health Insurance – Which Has a Better Network?

Small business plans have access to larger doctor and hospital networks, and provide access to many more specialist and top hospital systems. Individual plans, especially those on the Covered California exchange, are much more restrictive and limited in the doctor network.

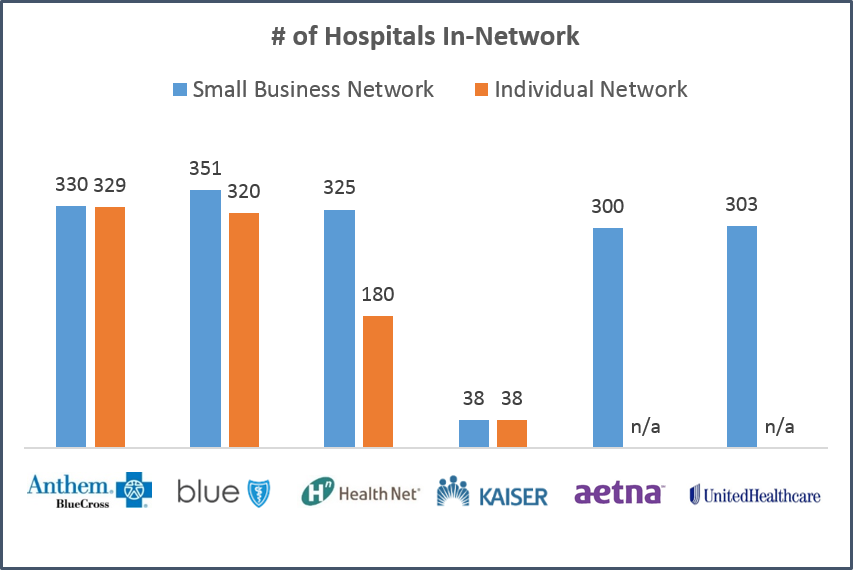

Hospital Network Comparison

- Anthem Blue Cross and Blue Shield of California have similar sized hospital networks for both the individual and small business plans.

- HealthNet’s individual network includes much fewer hospitals than the small business network.

- Kaiser Permanente has the same network for both the individual and small business plans.

- Aetna and United Healthcare have larger hospital networks under their small business plans, but don’t offer individual plans.

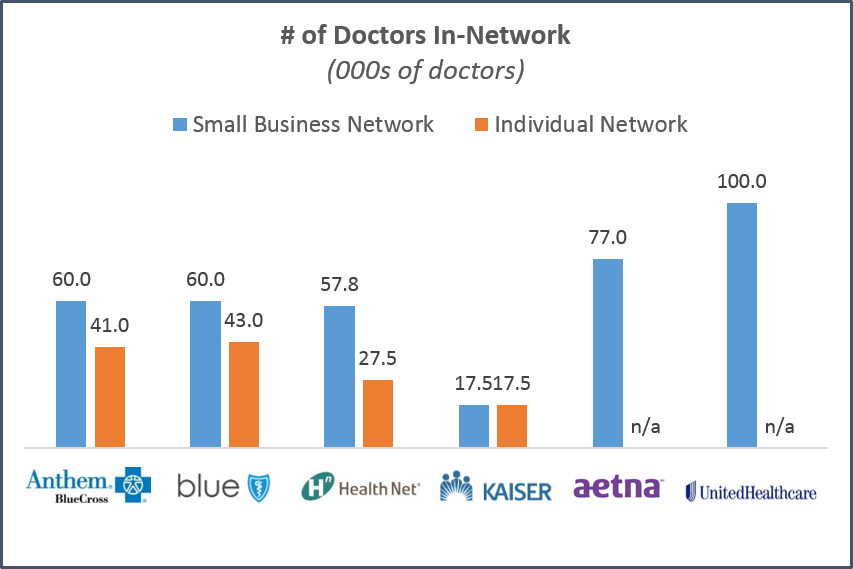

Doctor Network Comparison

- Carriers with PPO networks like Anthem Blue Cross, Blue Shield of CA, and HealthNet have 30-50% fewer doctors in the individual network compared to the small business network

- Kaiser Permanente has the same number of doctors in both the individual and small business plans.

- Aetna and United Healthcare have 2 of the largest networks in California, but are only available to small businesses.