How Are Health Insurance Brokers Licensed?

How are health insurance brokers licensed?

If you are a little confused about what health insurance brokers do, you’re not alone. Before you start working with a health insurance broker, you might also want to know what qualifies health insurance brokers to guide you through the process of selecting and enrolling in health insurance.

You’ll be glad to know that someone can’t just decide to become a health insurance broker one day, and then start selling health insurance the next day. Health insurance is a highly-regulated industry at both the federal level and state level. To protect consumers and ensure that these regulations are upheld, every state has a set of licensing requirements that brokers must meet in order to be eligible to sell health insurance. Though the requirements vary by state, there are two overarching steps individuals must take to become a licensed health insurance agent or broker:

- Pass an exam to sell health insurance in any state the individuals wishes to be licensed in

- Become an expert in any insurance the individual seeks to sell through training provided by the individual insurers.

Health Insurance Broker Exam

Individuals who wish to become health insurance brokers are required to complete a certain amount of pre-licensing coursework, 40 hours in Florida, for example, prior to taking the licensing exam in most states. Each state’s Department of Insurance provides additional guidance on the pre-licensing requirements. Once a potential broker completes any required coursework, that person becomes eligible to take the state’s agent or broker licensure exam. The exams vary by state, but all cover health insurance regulations at the national level, as well as state regulations in the state in which the exam is being taken. Other components of the exams include:

- Rules and regulations on the sale of health insurance

- How insurance claims are handled

- Health insurance terminology

- Various restrictions that might apply to the sale of insurance

Some states have reciprocity agreements that allow individuals to sell insurance across state lines without taking the state’s exam.

Health Insurer Requirements For Brokers

Health insurance brokers must be contracted through individual health insurers to sell that company’s products. The contracting requirements vary by insurer, but brokers are provided with the tools and information necessary to guide you through all of your health insurance needs. Health insurers provide brokers with:

- Training to meet any certification requirements

- Detailed product information

- Marketing material

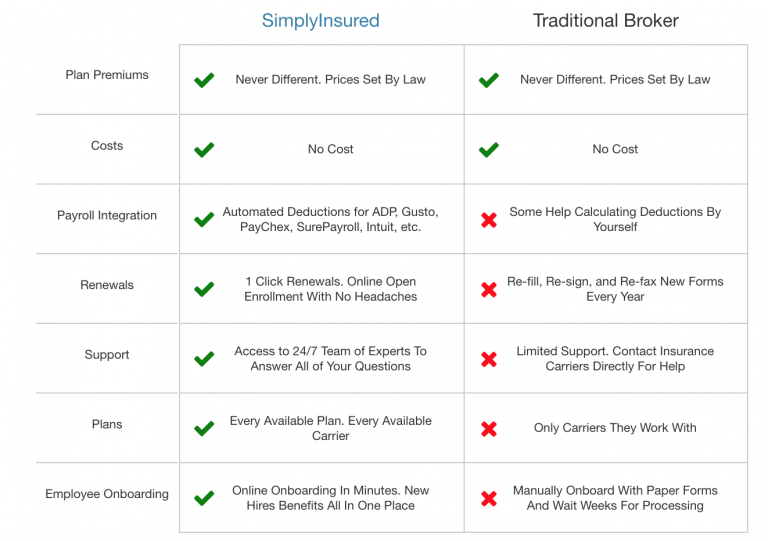

SimplyInsured is well-versed and knowledgeable in every insurance product we offer. We stay on top of all changes and updates made by the health insurers we work with. Health insurance brokers are the experts, so as the consumer, you should expect your broker to be your source of information and to not only help you select a health insurance that meets your needs, but also keep you informed of any updates and changes that might occur throughout the duration of your coverage.

The health insurance industry can be very intimidating, and health insurance brokers are the experts who work with you to help select the best product that best meets your needs. Health insurers brokers like SimplyInsured are technically also licensed health insurance agents. The difference with brokers is that they work with multiple insurance companies, and are knowledgeable about all of the products those various insurers offer. Agents, on the other hand, typically just work with a single insurance company.

Should you have any other questions about how health insurance brokers are licensed or how SimplyInsured can help guide you through the process of selecting health insurance for your small business, please contact us at support@simplyinsured.com.