Can My Small Business Get Insurance Without A Broker?

Can my small business get insurance without a broker?

Health insurance is complicated. As a small business owner whose focus is on the industry you specialize in, figuring out how to navigate the health insurance industry can consume a great deal of your time. While it is possible to figure out what works best for your company and employees and make a selection without the guidance of an expert, it’s a hassle you do not have to take on. Two ways to accomplish this are:

(1) through a broker;

(2) through an organization known as a professional employer organization (PEO).

In both instances, experts remove the guesswork that comes along with trying to obtain health insurance on your own.

The Good And Bad Of PEOs

PEOs provide business with a lot more than just health insurance. It’s just one of the services they provide to business owners. PEOs form co-employment agreements with employers and step in to handle many human resources functions, employee benefits, payroll and workers’ compensation. Because PEOs serve as co-employers with the companies they serve, the number of employees they serve puts them in the same category as large employers. This feature gives PEOs access to large group health insurance rates, which your business would otherwise not be privy to.

While PEOs have access to these large group health insurance rates, which may be lower than the rates that are available to small employers, these rates are only available through the insurer the PEO partners with. For example, if the PEO partners with Aetna, your company would only be able to choose from the Aetna health insurance plans the PEO offers.

PEOs are generally paid by businesses on a per employee rate. If you only plan to use a PEO for health insurance only, you will still be forced to pay the full per employee rate even though you don’t utilize all of the PEO’s services.

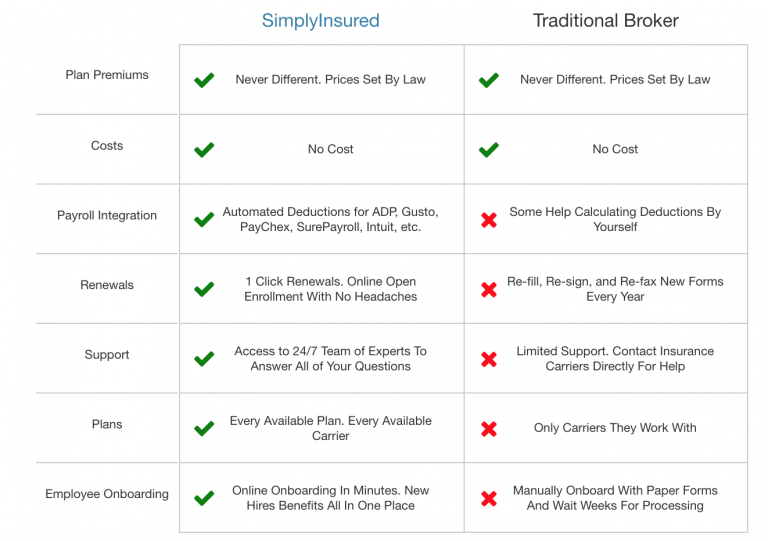

Benefits Of Using A Broker

Brokers are the experts when it comes to finding a health insurance plan that meets the needs of your employees. As a small employer, all you have to do is provide your broker with information about your employees, including their ages and whether or not they have dependents. With that information, along with your budget for providing health insurance benefits, a broker can provide you with quotes from multiple insurance carriers and give you the guidance you need to select the best plan or bundle of plans. You can input this information into SimplyInsured’s online form and receive instant quotes for your business.

In addition to costs, brokers are knowledgeable about the details of the various plans they quote. Brokers are your resource for navigating health insurance. They are paid by health insurers through commissions; you do not pay for the services brokers provide.

| Broker vs. PEO | ||

|

Broker |

PEO |

|

|

Access to multiple insurers |

Yes | No |

|

Provides various HR services |

No |

Yes |

| Specializes in health insurance | Yes |

No |

|

Business pays for services directly |

No |

Yes |

Why Use A Broker

There are a number of ways to go about obtaining health insurance for the employees of your small business. It’s important to consider the amount of understanding you have about various health insurance options, as well as the amount of flexibility you desire when it comes to selecting plans.

The sole focus of a broker like SimplyInsured is to work with you to find the best health insurance products for your business and your employees. While PEOs offer a greater range of services, the targeted focus and expanded reach of a broker puts you in a better position when it comes to meeting the needs of your specific business. You’re not limited when you use the services of a broker.

SimplyInsured is fully capable of gathering the necessary information about your business, then using that information to match you with health insurance options that will keep you and your employees happy. Once you make you selection, SimplyInsured can guide you through enrollment and management of your plan, including adding members, fully-automated payroll deductions and premium payments.

Get started with an instant quote today, or contact us at support@simplyinsured.com for additional information.